Market for steel service companies

BE Group and other steel distributors play an important role in the value chain. They bridge the gap that exists between steel producers’ delivery capacity and steel consumers’ needs. The individual steel producers provide a limited selection of products, often in bulk and with relatively long lead times. However, many steel consumers seek a single coordinated supply of several different products in smaller quantities with short delivery times. Purchasing is then normally conducted via a steel service company, where BE Group is one of the leading producer-independent suppliers.

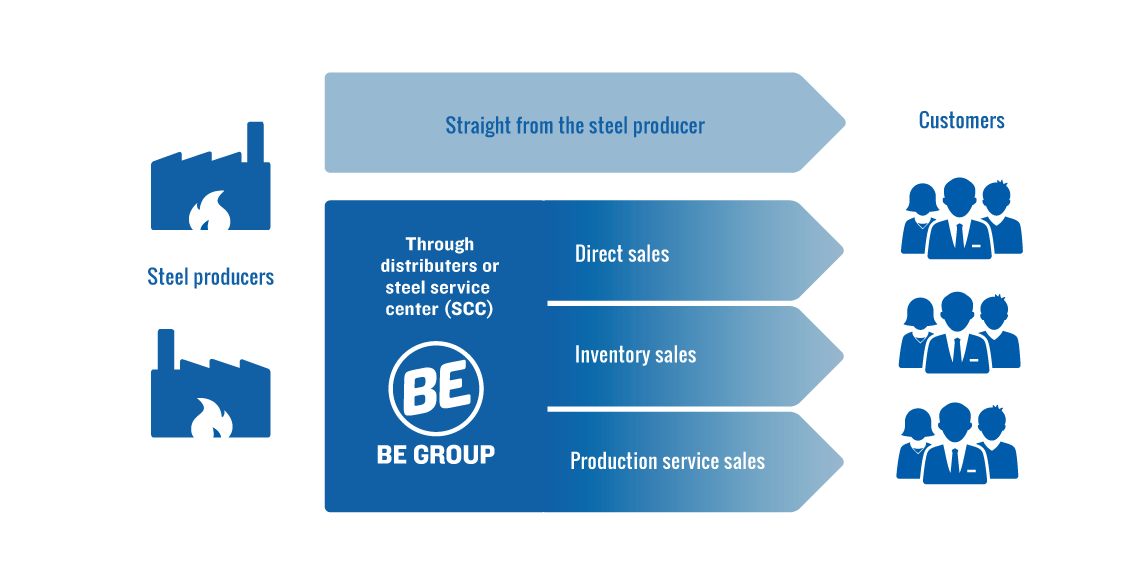

The road to market – from producer to customer

The chain from production of the steel to its final use by the purchaser of the steel can mainly take place in two ways. Around 40 percent of the tonnage is supplied directly from the steel mills to the customers, and around 60 percent of the tonnage is delivered through distributors and steel service centres, i.e. BE Group’s market.

The steel mills most often sell directly to customers that consume large volumes of steel in, for example, the shipbuilding and automotive sectors. Direct deliveries are more common in the flat products segment, where volumes are often large and the need for further processing before delivery is lower.

Purchases through distributors and steel service centres meet an important need among customers by being able to offer single coordinated supply of several different products in smaller quantities with short delivery times. The materials are more often delivered in a further refined condition.

From producer to customer

The chain from the production of the steel to its final use by the purchaser can, put simply, take two different forms.

Drivers and success factors

Some of the most important drivers for BE Group’s market are:

Construction

Construction of buildings and infrastructure drives demand for various kinds of steel products, from reinforcement and beams for bridge building to stainless steel for kitchen furnishings.

Industrial production

Industrial production is the single largest factor that affects the demand for steel and steel products. A good example is the development in the automotive industry and OEM customers that generates a large demand in BE Group’s market.

Important success factors in the market for steel distributors are:

High delivery precision

Delivery of the right products at the right time is important for our customers.

High level of expertise and good service

Good knowledge of the customers’ needs and our own products as well as good availability.

Right price

Having cost-effective offers for the customers.

Personal sales and a local presence

Working close to the customers and contributing with knowledge and service.

Competitors

In Sweden and Finland, BE Group is the second largest player. Tibnor has the largest market share in both of the markets. Other competitors are Stena Stål in Sweden and Kontino and Flinkenberg in Finland.

| Amounts in SEK M | ||||

| Company | Sales | Change 2015/2016 | Operating profit 1) | Operating margin 1) |

| BE Group | 3,870 | -7% | 61 | 1.6% |

| BE Group Adjusted 2) | 3,715 | -1% | 74 | 2.0% |

| Tibnor | 6,879 | -4% | 108 | 1.6% |

| Stena 3) | 1,619 | 1% | 37 | 2.3% |

1) Excluding items non-recurring items (For BE Group SEK 45 M)

2) Excluding operations under reconstruction where sales in 2016 were SEK 155 M (386) and EBIT excluding non-recurring items was SEK -13 M (-12)

3) Information refers to the financial year September 2015 to August 2016

Steel market

In its “Economic and Steel Market Outlook 2017-2018” from 1 February 2017, Eurofer assesses that demand for finished steel products will increase by 0.7 percent from 155 million tonnes in 2016 to 156 million tonnes in 2017 in the EU. By comparison, steel consumption in Sweden amounted to 3.4 million tonnes and in Finland and the Baltics it was 2.9 million tonnes in 2015 according to World Steel.

The graph below shows the historical steel demand in the Group’s markets, and in the EU as a whole where the forecast for 2017 has also been included.

According to Eurometal’s “Outlook on Economies & Steel Markets” from February 2017, the consumption of steel in the construction industry will increase in 2017 in contrast to 2016. The automotive industry’s consumption is expected to continue to increase in 2017 for the fifth consecutive year.

| Growth forecast per end user in steel for EU | 2011 | 2012 | 2013 | 2014 | 2015 | E 2016 | F 2017 |

| Construction | +3.7% | -5.1% | -2.9% | +1.7% | +1.6% | -0.2% | +2.1% |

| Mechanical engineering | +10.2% | -0.5% | -3.8% | +1.5% | +0.1% | +0.7% | +0.7% |

| Automotive | +10.9% | -4.6% | +1.0% | +4.9% | +7.5% | +5.5% | +3.2% |

| Domestic appliances | -5.5% | -1.3% | +0.2% | -0.3% | +4.3% | +1.1% | +0.3% |

| Metal ware & goods | +8.8% | -2.7% | -0.3% | +2.5% | +2.2% | +2.5% | +1.9% |